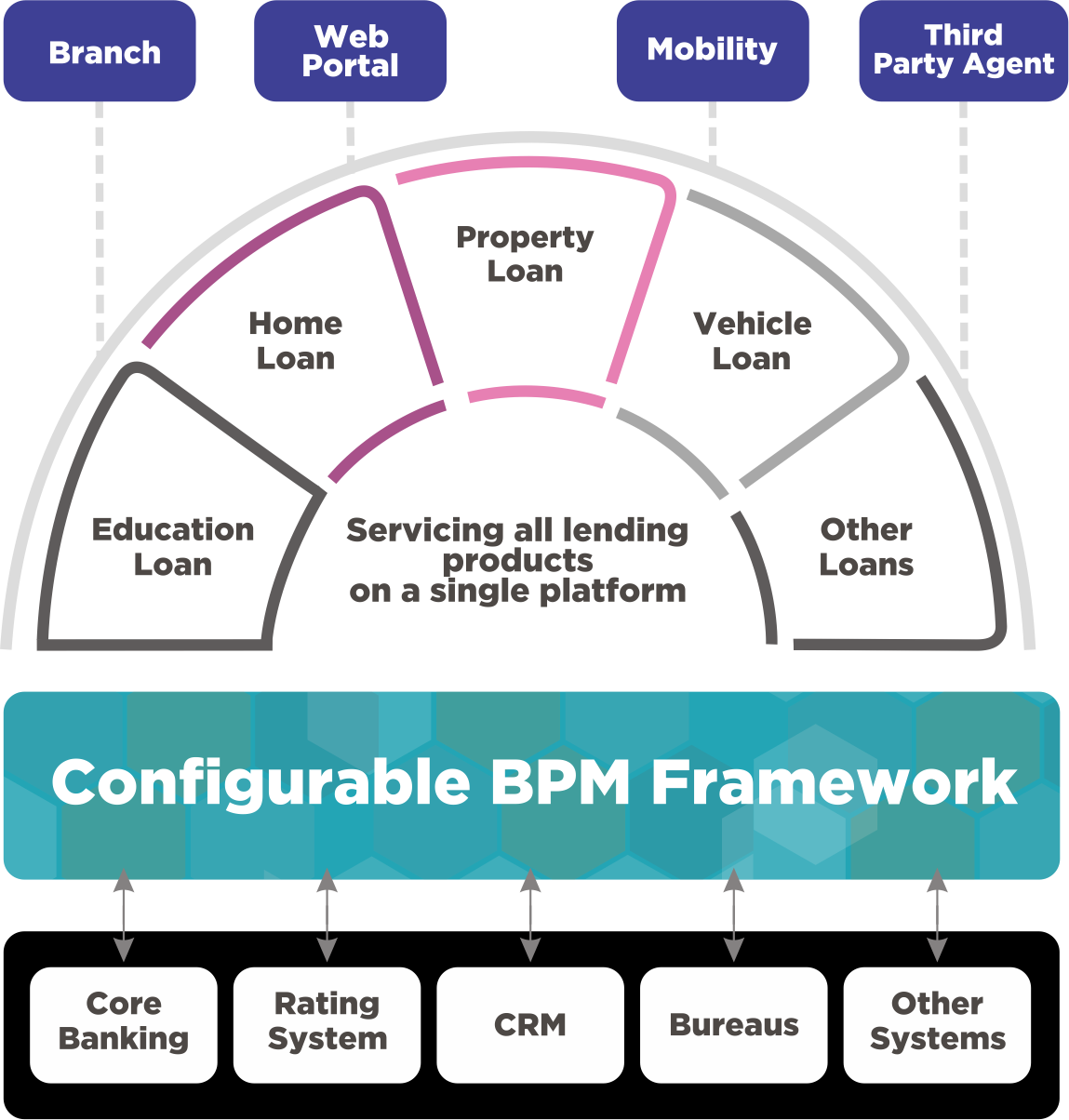

Leverage scalable lending solutions to cater to all kinds of loans with a digital automation platform. Learn how AVS loan origination software can enable you to ensure compliance with regulatory requirements and streamline your lending processes by bridging operational silos and unifying your front and back offices.

AVS offers an extensive portfolio of products and applications to cater to all your industry-specific needs. Our loan origination solutions, built on a low code digital automation platform, enables your financial institution with the flexibility and adaptability to stay future-ready.

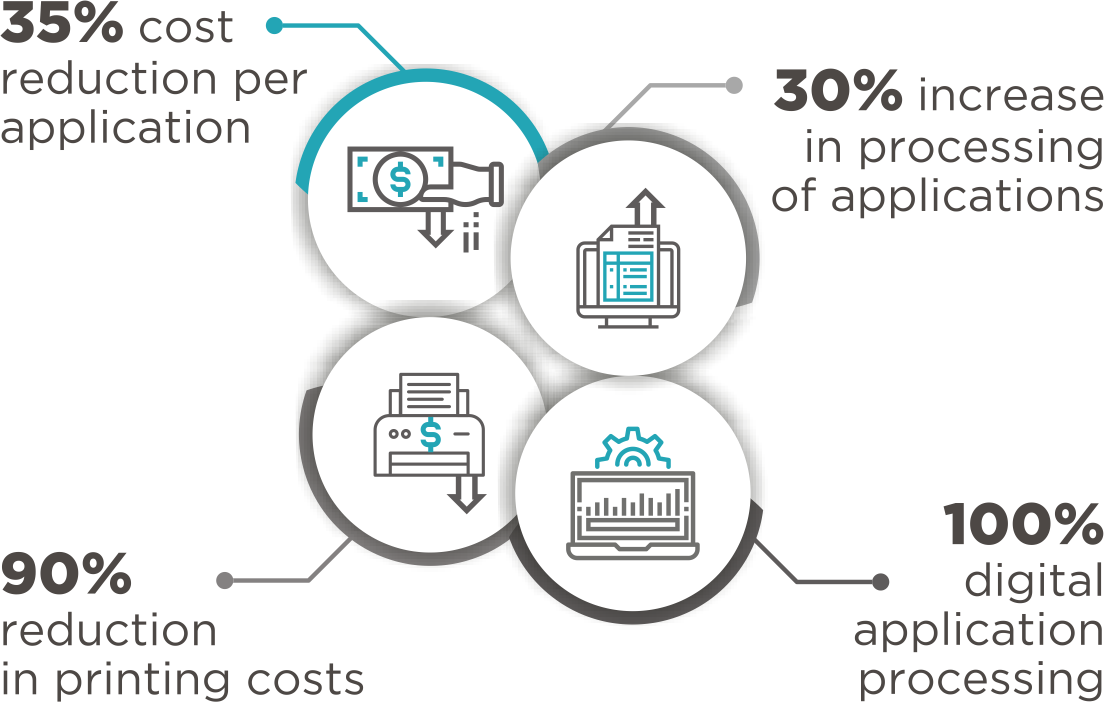

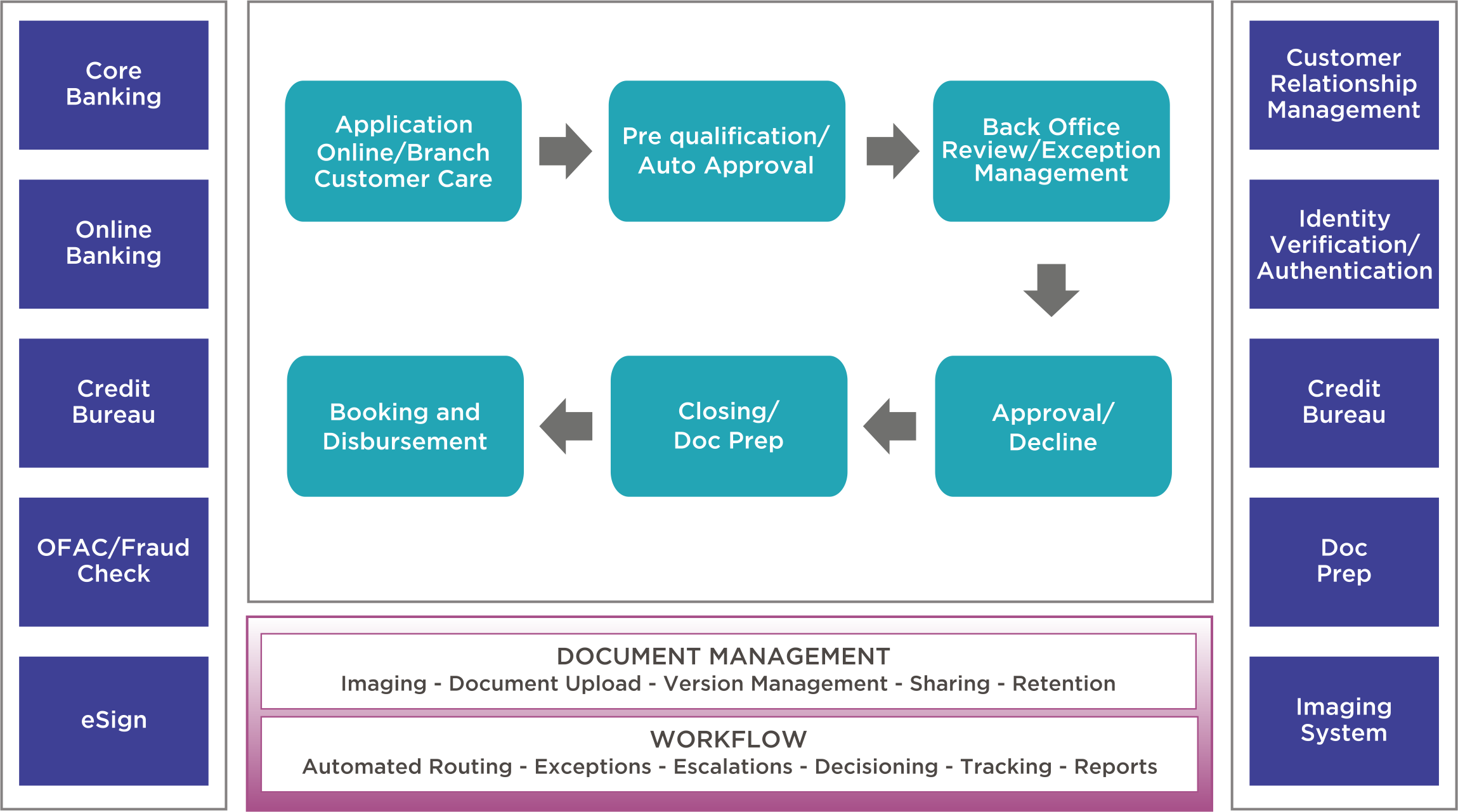

Digitalized application management and zero-touch, paperless processing channel and multi-channel loan application initiation and document submission Intelligent underwriting module, comprehensive loan document checklist, and automated alert

Rule-driven decisioning with comprehensive credit assessment and risk rating tools to ensure compliace

Methodical portfolio monitoring and collateral management Real-time dashboards to monitor critical business events and operational productivity

Seamless integration with multiple third-party system and core banking solution

Workflow-based exception and deviation managemant

configurable application and pre-defined templetes to mitigate coding-related

costs and generate loan packages..

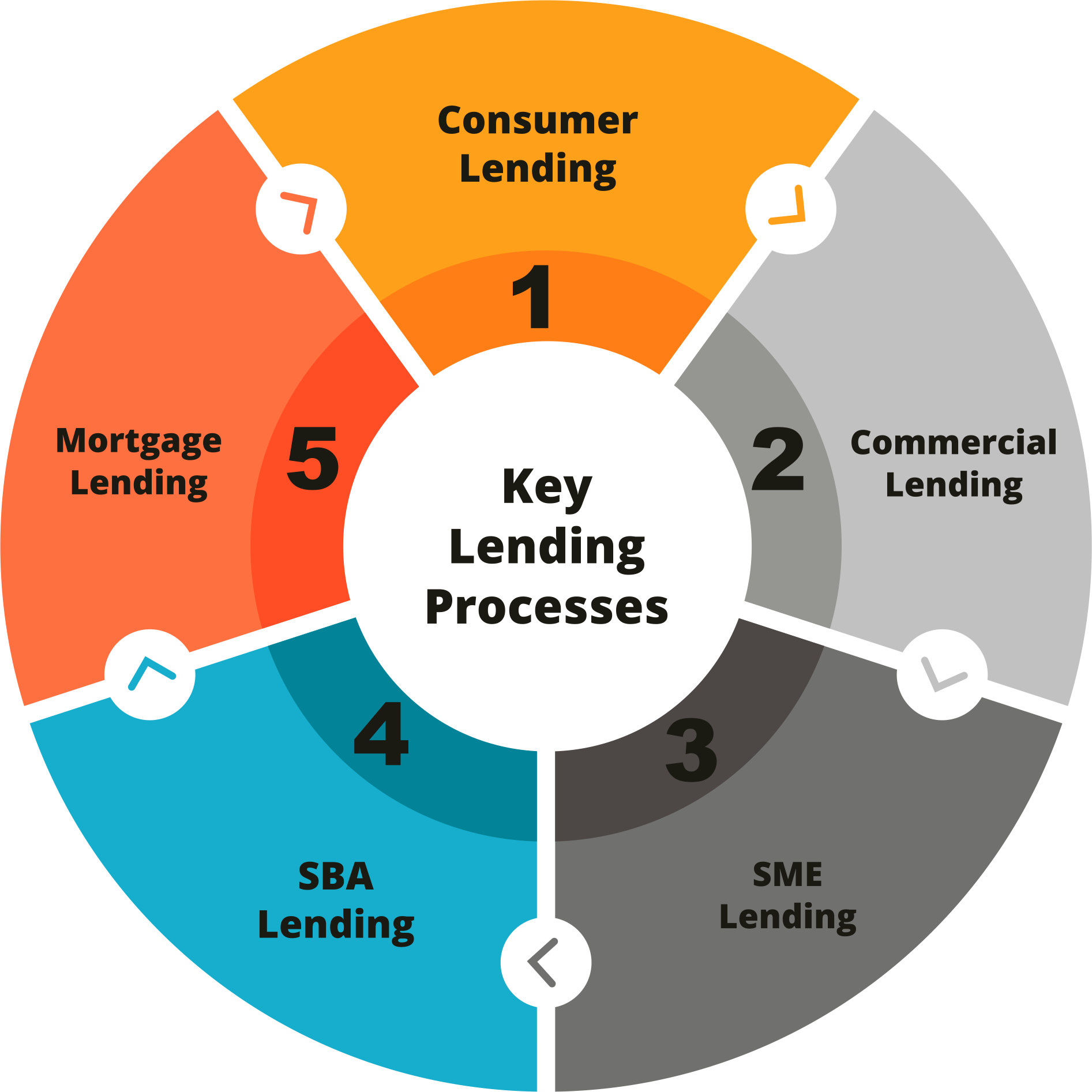

A Wide range of lending solutions to fast-track your loan origination, review, and renewal processes

AVS offers a highly configurable solution, built on our low code automation platform, that optimizes the consumer loan origination cycle. The solution automates the complete leading process-per-screening, application processing, underwriting, and disbursal-across a wide renge of loan products.

Easily add, delete, and manage loan covenants during the approval process and throughout the loan lifecycle.

Standardize your financial analysis processes, ensure faster loan processing and enable better credit decision-making Collateral management Track,report and configure workflowe by associating them with a specific collateral type

Track,report and configure workflowe by associating them with a specific collateral type.

Loan eligibility calculation based on demographics, income, and credit history

Data capture and due diligence of applicant, and guarantor

AVS solution for small business administration (SBA) lending automates the lending lifecycle - from submission to qualification, approval, and funding-in a paperless environment while reducing overall expenditures and ensuring regulatory compliance

Leverage an out-of-the-box solution with built-in configurability to make your lend ing process more scalable and efficient. The solution offers the best of both worlds (buy vs build) and seamlessly enables you to meet the automation requirements and comply with the dynamic SBA guidelines.

AVS approaches small business lending as a unique product with huge opportunities for straight-through processing and minimizing operational risk.

AVS solution for small and medium enterprise (SME) lending the full range off SME loan types in a paperless, electronically driven environment. It seamlessly integrates with legacy systems and third-party applications to maximize your existing investments and future-proof your enterprise with agility, scalability, and efficiency.

Furthermore, AVS SME lending solution helps you to :Enable credit origination, approval, and monitoring

Ensure configurability with an SME lending accelerator

Facility straignt-through processing of SME loan applications.

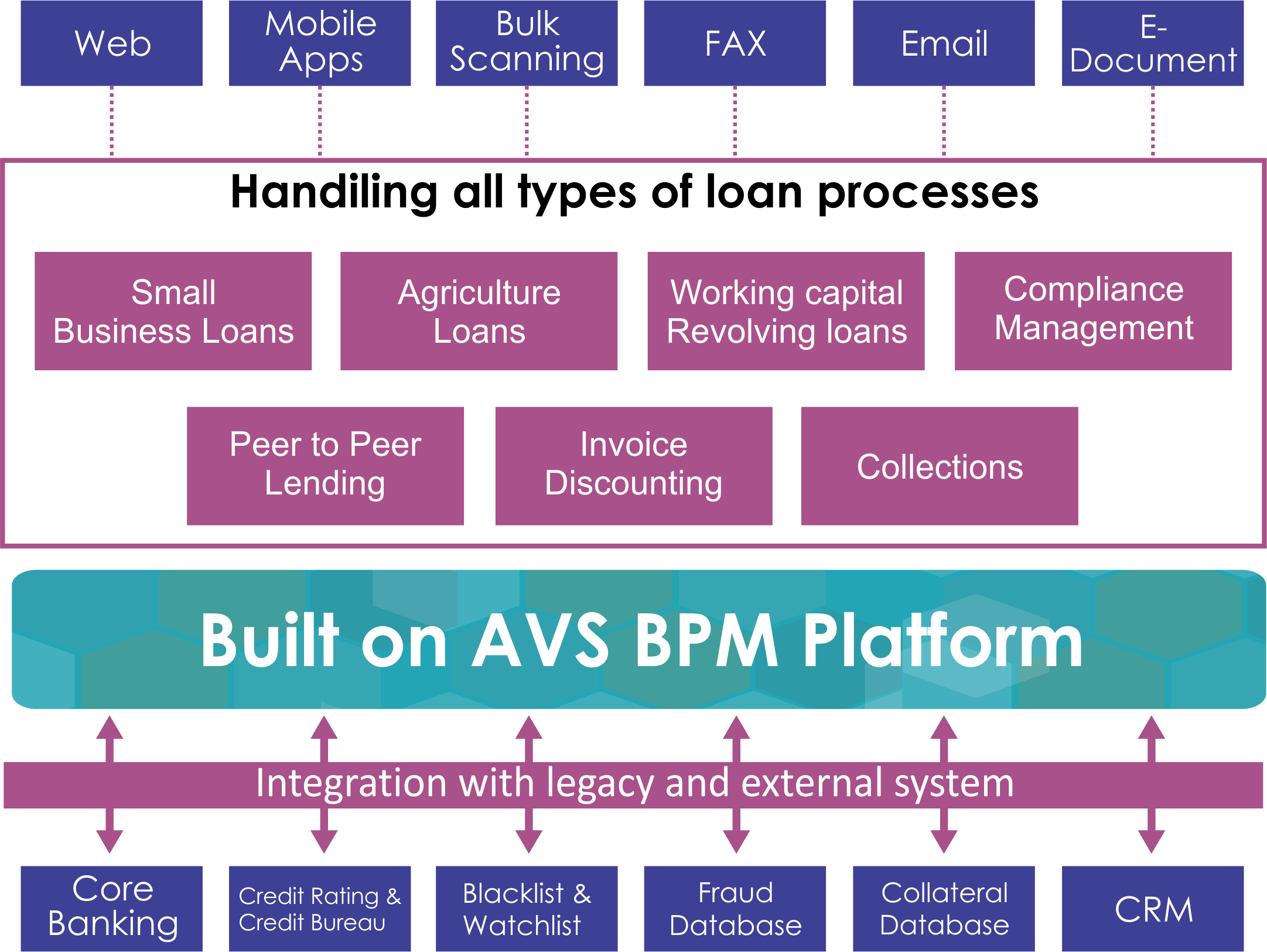

The key to successful SME lending is the automation and digitization of the end-to end onboarding and loan origination processes, using a low code automation platform that seamlessy integrates with core system. Web Mobile Apps Bulk Scanning FAX Email EDocument Handiling all types of loan processes Small Business Loans Agriculture Loans Working capital..

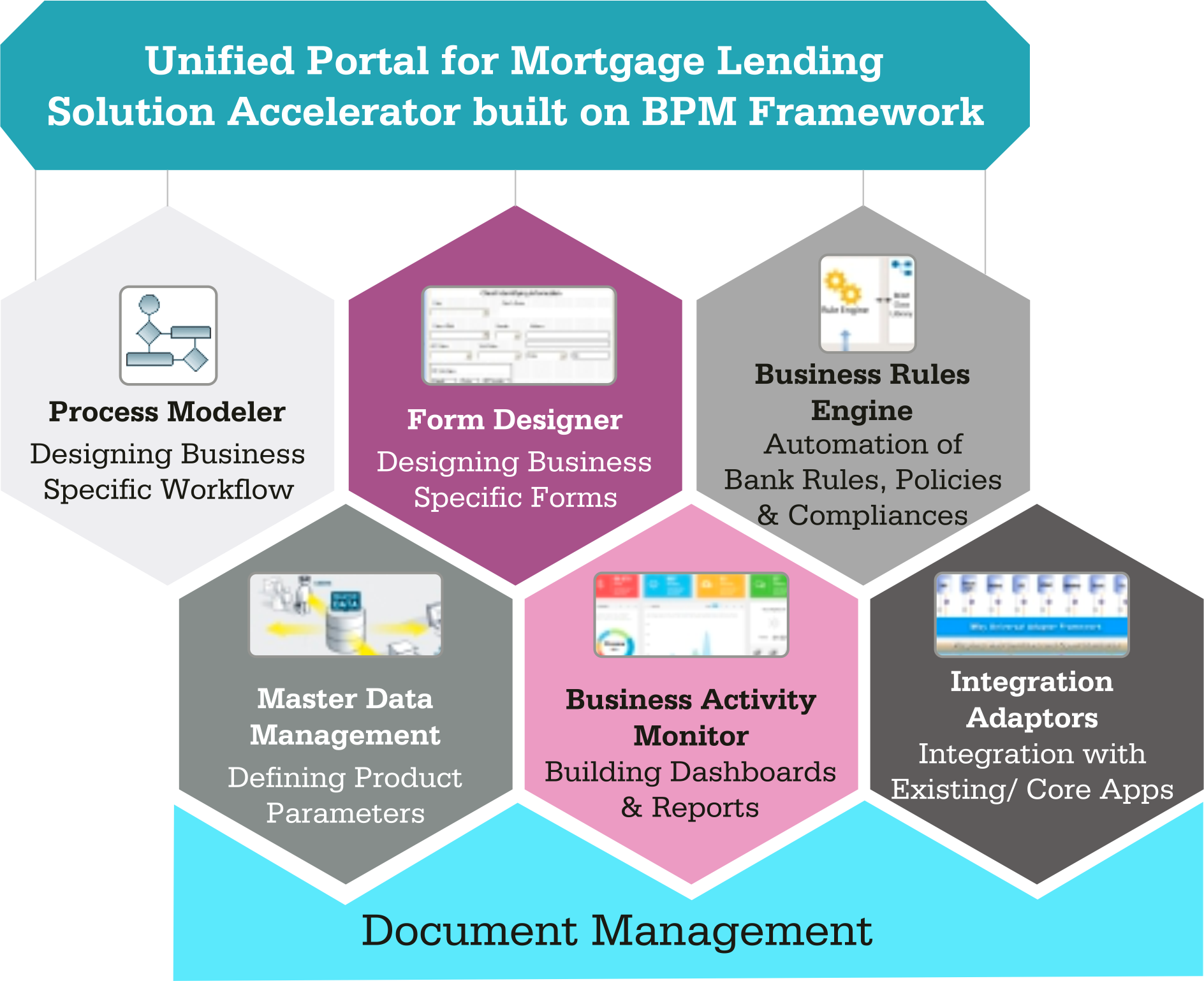

AVS solution for mortage lending automates the complete mortage lending lifecycle, from origination to underwriting, disbursement, and servicing. Implementing our configurable solution will enable you to stay ahead of ever-changing regulatory compliance.

The solution is built on a business process management (BPM) framework and offer a portal with a unified view to enable mortgage origination, approval, and monitoring in a paperless environment. Furthermore, the solution employs credit checks to remove duplication and identify possible defaulters. Credit checks and defaulter identification based on blacklist, anti-money laundering, persona non grata and various other checks Comprehensive credit

based on blacklist, anti-money laundering, persona non grata and various other checks

that consider financial, employment, account conduct,and pricing information

based on status, such as deferred, waived, received, and pending.